Instant settlement,

Smarter rewards

to create, distribute and settle rewards

Vertically integrated

Rewards-as-a-Service

for retailers and brands

GFT’s Rewards-as-a-Service is an end-to-end collaborative, featurerich B2B and B2C service that makes it easier and more cost effective for retailers, brands, and agencies to create, budget, distribute, and settle both paper and digital rewards. GFT’s Rewards-as-a-Service can be used as a complete turnkey white label solution or integrated to augment existing technology.

Instant settlement and payment

Self-liquidating rewards

GFT’s self-liquidating rewards instantly clears and settles all reward types. Retailers are paid the face value of coupons upon redemption, while shoppers are paid for rebates at the moment of check-out. Our automated settlement process ensures transaction authenticity, financial reporting accuracy, and the elimination of fraud.

No fraud

No manual accounting

Automated instant settlement

Instant transaction data

Performance

Save money, increase profitability

Retailers and brands benefit from lower operating costs across in-store and corporate operations.

Retailers

Our Rewards-as-a-Service eliminates all manual intervention to reconcile and process rewards, resulting in time and cost savings from day one.

Traditional reward programs often involve third-party clearinghouses or intermediaries to process and settle rewards. Self-liquidating rewards clear and settle automatically eliminating time and costs associated with this process.

Processing of rewards requires dedicated infrastructure, personnel and resources. By automating these tasks, retailers can eliminate accounting processes, reduce the need for manual intervention, and lower overall capital expenditures associated with reward management.

Brands

Brands often incur costs associated with clearing and settling rewards with retailers. These costs can include transaction fees, processing fees, and other charges levied by intermediaries and retailers. By using GFT, brands can mitigate or eliminate these costs altogether.

With traditional reward programs, brands may reimburse retailers for the costs associated with redeeming and processing rewards. With GFT, retailer overhead related to these tasks can be mitigated or eliminated altogether, resulting in recurrent savings to the brand.

Brands often offer rebates and cash-back incentives that come with associated processing costs, including handling rebates, verifying purchases, and issuing payments. With GFT’s automated settlement, brands can eliminate the processing of these incentives, resulting in lower costs. Instant settlement also includes instant payment of rebates to shoppers.

User friendly

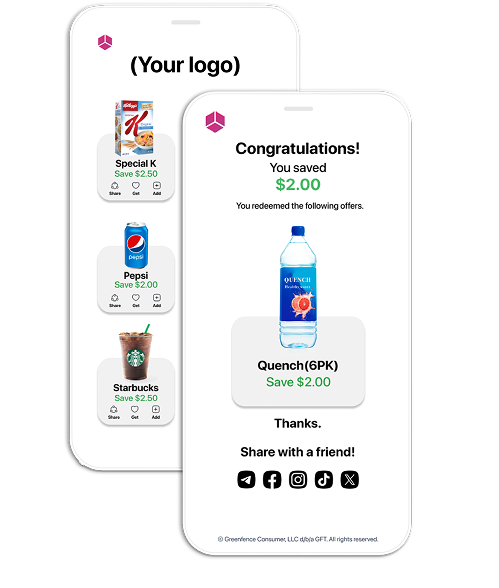

Fully integrated wallet

Our white label wallet can be used independently or integrated with

third party solutions. Seamlessly integrated with GFT’s Rewards-as-

a-Service, it includes all of the service features and benefits,including self-liquidating rewards. Its User Interface is configurableand can be tailored to any UI specification.

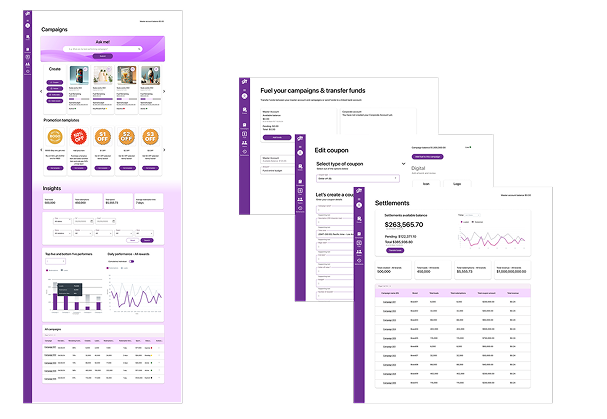

Lifecycle intelligence

Big data, insights,

KPIs

GFT generates micro transaction data throughout the

shopper journey and reward lifecycle to produce real-

time actionable intelligence. Data is automatically

analyzed and published in real-time to the retailers and

brands who own the data. Insights and KPI’s are

displayed using easy to interpret graphs and charts.

Finger on the pulse

Control shopper

marketing budgets

GFT’s zero latency verification of redemptions and settlements

automates shopper marketing budget management. Budgets can be

adjusted on demand during the reward lifecycle.

Full campaign control

Set budget limits

Mid campaign adjustments

Adjust volume and dollar values

Adjust expiration dates

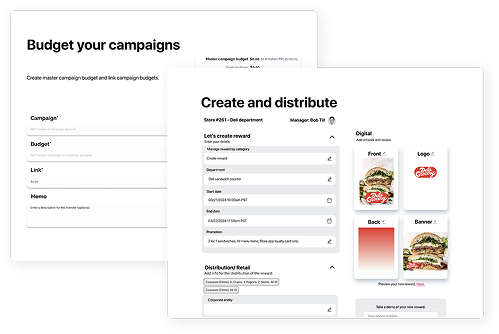

Instant micro marketing and promotions

Empower in-store managers to distribute rewards on the fly

In-store department managers can use GFT to create, distribute, and

customize self-liquidating rewards on-the-fly. This level of agile

control enables managers to respond swiftly to changing market

conditions, consumer behavior trends, and inventory levels,

ultimately maximizing the impact of marketing budgets, P&L

performance, shrink reduction, and shopper delight.

Optimizing acquisition and retention

Automated reward

curation and

redemption

Automated reward curation at checkout provides both the retailer

and brand last-minute opportunities to deliver unexpected rewards

to shoppers. This surprise and delight moment enhances retention

of existing shoppers and promotes the acquisition of new ones.

Automated curation eliminates the need for shoppers to scan

receipts, clip rewards, or count coupons at checkout, enabling an

instantly gratifying experience.

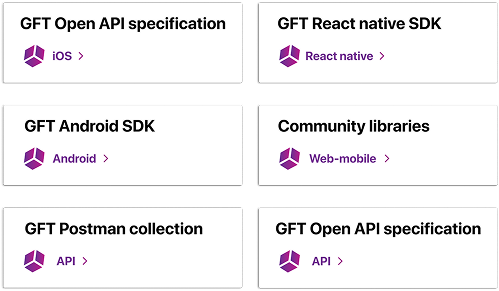

APIs, SDKs

Developer friendly

Unlock the potential of your loyalty and rewards program with

minimal effort using our APIs and SDKs. Designed for developers of

all skill levels, our toolkit allows you to incorporate our functionality

on your stack, use of pre-built integrations, or to build on our stack.

Immutable trust and accountability

Blockchain

GFT’s high-performance blockchain is known for its fast transaction

speeds and security. GFT records and accounts for the end-to-end

operating, transactional and financial life-cycle of redemptions,

including clearance, settlement and payments. GFT key features and

capabilities include:

GFT supports smart contracts, enabling the creation of programmable agreements that automatically execute when predefined conditions are met. Smart contracts can be utilized to automate redemptions, clearance, and settlement by encoding the rules and conditions governing these processes onto the blockchain.

GFT’s architecture is designed for high throughput, capable of processing 10,000 transactions per second. This transaction speed ensures that redemptions, clearance, and settlement can be processed quickly and efficiently, minimizing delays and providing a seamless user experience.

GFT’s blockchain provides an immutable ledger that records all financial transactions in a transparent and tamper-proof manner. This ensures the integrity and accuracy of redemptions, clearance, and settlement, with full transparency and accountability.

Risk solved

No fraud, no problem

GFT eliminates fraud and the redemption of fraudulent, counterfeit,

and duplicate paper and digital rewards, including digital codes

commonly found across the Internet and used by coupon curators

on e-commerce platforms.

No costs

No additional software

No additional time and effort

No committees

No committees

Secured advanced learning and predicting

AI

GFT utilizes the latest AI technology, actively participating in

enterprise solutions and collaborating with best of breed and open

source AI solutions to beta test new features relevant to our RaaS

marketplace and clients. Our partnerships span across the grocery,

CPG, mobile, and entertainment sectors, and focus on securing,

integrating and commercializing intellectual property and data for

our respective clients.

AI can detect and prevent fraudulent activities related to reward redemptions, clearance, and settlement by analyzing transactional patterns and identifying anomalous behavior. By implementing AI-driven fraud detection systems, businesses can safeguard their reward programs and maintain trust with their customers.

AI algorithms can analyze large volumes of transactional data related to redemptions, clearance, and settlement. By identifying patterns and trends in user behavior, AI can help businesses understand customer preferences and optimize reward programs better.

AI can utilize predictive modeling techniques to forecast future redemptions and optimize inventory management and resource allocation. By anticipating demand and adjusting reward distribution accordingly, businesses can minimize stockouts and maximize the effectiveness of their reward programs.

AI can automate various processes related to reward distribution, clearance, and settlement, reducing the need for manual intervention and streamlining operations. For example, AI-powered chatbots can handle customer inquiries about reward status and provide real-time support, enhancing user experience and efficiency.

By analyzing individual user preferences and past redemption behavior, AI can generate personalized reward recommendations tailored to each customer’s unique interests, budgets and needs. This personalized approach increases engagement and encourages repeat purchases, driving customer loyalty and retention.

One of the key benefits of AI is its ability to continuously learn and improve over time. By collecting feedback and performance data from reward programs, AI algorithms can iteratively optimize processes and strategies to enhance efficiency and effectiveness.

Let's get started

"*" indicates required fields

Reach out at

hello@gftrewards.com

410 S. Rampart Blvd. Suite 350

Las Vegas, NV 89145, EE. UU.